By Peter Dada

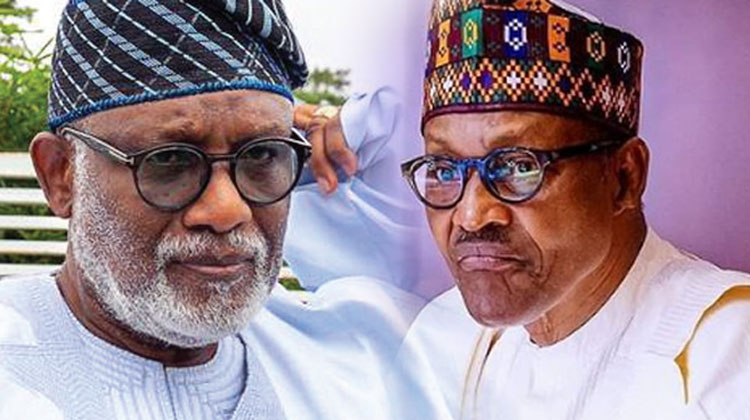

The Ondo State Government has filed a suit against the Federal Government at the Supreme Court over the Central Bank of Nigeria’s directive on limitation of cash withdrawal from banks.

It was gathered that the government filed a separate application to join the suit instituted earlier by the Zamfara, Kaduna and Kogi States at the apex court on deadline issue by CBN on swapping of old naira notes for the new notes.

The Ondo government asked the apex court to stop the implementation of the policy.

In an originating summon filed and signed by the Attorney-General of the state, Mr. Charles Titiloye, the government prayed the Supreme Court to stop the implementation of the directive issued by the Federal Government through the CBN on limitation of daily cash withdrawals from banks which, it said had totally paralysed the activities of Ondo State and has adversely affected economic and commercial activities in the state.

The statement issued by the Special Assistant to the AG, Kola Adeniyi, said, “The Ondo State Government contended that the guideline on daily maximum cash withdrawal made by Federal Government is an infraction on the legal rights of Ondo State Government and its citizens to access funds for execution of developmental projects, small credit facilities to petty traders (who have no account in banks) and highly detrimental to daily commercial activities in the state.

“Ondo State Government urged the Supreme Court to declare that the Federal Government cannot by directive issued through Central Bank of Nigeria, amend or vary an existing Act of National Assembly particularly Section 2 of Money Laundering Act which relates specifically to limitations on cash withdrawals for individual and Corporate organisation to N5million and N10million respectively. The updated guidelines issued by CBN now places maximum withdrawal for individual and corporate organisation at N500,000 and N5million respectively.

“Ondo State Government is asking the Supreme Court to decide whether the guidelines issued by Federal Government on maximum daily cash withdrawal and the continuous suffering and hardship caused by the implementation of the said policy is not in conflict with the express provision of Section 2 of the Money Laundering Act, Sections 20, 39 and 42 of the Central Bank of Nigeria Act.

“Ondo State Government averred that while it has more than 149 ministries, departments and agencies to run on daily basis in a state with more than three million people, less 500,000 people have bank accounts through which bank transfer can be made. Consequently the policy of the Federal Government has totally paralysed the economy of the state.

“Ondo State Government averred that the citizens of Ondo State now spends precious hours at banks ATM waiting to collect the new naira note while citizens in the rural areas and villages without banks and Internet facilities have been shut out from receiving or transferring money to meet their daily economic needs.”

The government urged the apex court to intervene and stop further implementation of the said Federal Government policy.

Source: The Punch