FairMoney, a leading financial service provider, has announced an update to all its savings services, delivering some of the highest interest rates in the Nigerian financial market.

This increase, according to the firm, underscores its ongoing commitment to providing exceptional value and supporting customers’ financial growth.

Given the current high inflation of 32.7 per cent as of September 2024 as released by the Nigeria Bureau of Statistics, The company said it intends to provide customers with options that improve their return on savings.

“As part of the update, FairLock now offers up to 28 per cent interest per annum, with an exclusive 30 per cent per annum on certain tenures for first-time users.

This makes FairLock an even more rewarding fixed-term deposit option where users can securely lock their funds and enjoy between 18 per cent and 28 per cent p.a upfront interest payments.”

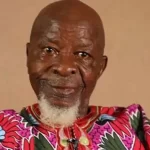

Commenting on the development, the Managing Director of FairMoney, Henry Obiekea, reaffirmed the company’s commitment to supporting customers’ financial growth and ensuring a rewarding savings experience.

“We understand that saving is an important part of financial growth, and we want to ensure that our customers are not just saving but also growing their wealth with the best returns.

With the new 28 per cent interest rate on FairLock, 20 per cent interest rate on FairTarget, and 17 per cent interest rate on FairSave, our goal is to ensure that we continue to prioritise customer satisfaction, ensuring that they have the most beneficial and rewarding savings experience,” he said.

He revealed that another savings product, FairTarget, now offers a competitive 20 per cent interest rate per annum, an increase from its previous 17 per cent per annum.

“This provides customers with a flexible, secure, and rewarding way to save toward their financial goals while earning substantial returns. “FairSave on the other hand, changed from 15 per cent per annum to an increased interest of 17 per cent per annum.

This product offers daily interest accrual and the flexibility to withdraw funds to a FairMoney bank account at any time without penalties, making it ideal for users looking to save for short-term goals while keeping their funds easily accessible.

“FairMoney’s competitive interest rates, fast transaction processing time, and minimal service disruptions are highly favorable for salary earners, seeking reliable financial services to receive and grow their money, without sacrificing flexibility or accessibility,” he stated.

great articlehttps://presensi.uinjambi.ac.id/assets/ Terpercaya