By Temitope Hassan

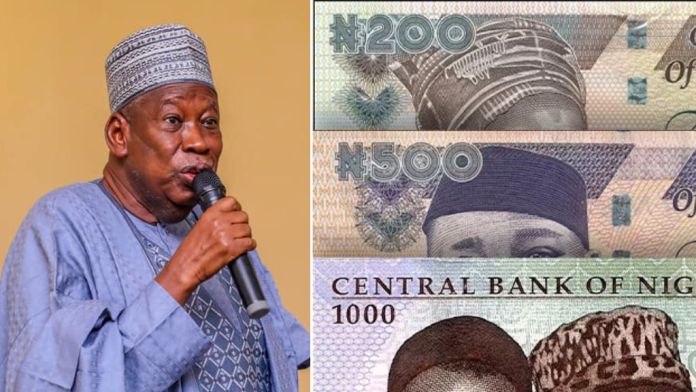

Kano state governor, Abdullahi Ganduje of Kano state has threatened to sanction banks and businesses rejecting the old naira notes.

The governor cited a Supreme Court interim injunction that allowed the use of old notes alongside new ones until the old ones are phased out.

Governor Ganduje said he noticed that some businesses are rejecting old notes, worsening the situation due to the lack of new notes.

The governor emphasized that the old notes are still legal tender and that the government may revoke the licenses of businesses that do not comply.

“Business and economic activities are seriously affected by the naira redesign and unfortunately some self-centered individuals are cashing on the situation to cause further hardships on the people by not accepting the old naira notes during transactions,” the statement added.

He said the people have suffered enough untold hardship and therefore the state government would not fold its arms and allow a few selfish elements to worsen the situation.

The Governor called on the people in the state to continue with their lawful businesses and report anyone who refuses to accept the old naira notes to the appropriate quarters.

Nasarawa Governor Abdullahi Sule has stated the Central Bank of Nigeria (CBN) is pursuing its cashless policy wrongly.

The policy, he said, is causing innocent Nigerians needless pain.

The Governor spoke during an interactive session with APC stakeholders in Obi local government in continuation of his second term campaign.

The Governor said: “The reason why people are facing difficulty is that the new naira notes were not printed enough. In Nigeria, we have about N3 trillion in circulation. But the CBN only printed N200bn new naira, which is inadequate, actually, the CNB merely collected money from the hands of Nigerians.

“Some people are complaining because they don’t understand the economic situation of the world. They claim that Nigeria has too much money in circulation.

”This is far from the truth, if you look at what is happening in the US, and how that country transited to a cashless society, you will understand better, but 20 percent of the US wealth is cash in circulation. In India, 15 percent of the country’s wealth is in circulation.

“In Nigeria, the country’s collective wealth is over N50 trillion but out of this, only N3 trillion is in circulation, which is less than 5 percent. The argument that there is too much money in circulation in Nigeria is not true. By the time the cash in circulation reaches about N10 trillion that is when we can push to transit to a cashless society.”

Source: intelregion

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.