By Nkiruka Nnorom

Manufacturers of food and beverages have reduced production by 20 percent following declining demand from consumers as a result of persistent rise in prices reflected in further rise in food inflation rate to 31.52 per cent in October.

The fall in demand has also made it difficult for these manufacturers to sell finished goods as their stock of unsold finished goods rose by 34.03% year-on-year to N78.82 billion in the nine months ending September 30, 2023 (9M’23).

Recall that the inflation rate in Nigeria has been on a constant increase, rising by 5.95 percentage points to 26.72 percent in September 2023 from 20.77 percent a year ago, triggered by various factors including high energy cost, insecurity, especially in the farming communities in Nigeria, Russia-Ukraine war among others.

Besides, the pump price of petrol, otherwise known as premium motor spirit (PMS), has risen by 127.8 percent this year alone from N257.12 per litre in January 2023 to an average of N560 per litre in September, all these combining to pressure consumer wallets and undermine their purchasing power.

Dealers narrate low patronage, consumer apathy

To cope with this situation, consumers are reducing demand or quantity of food and beverages they buy.

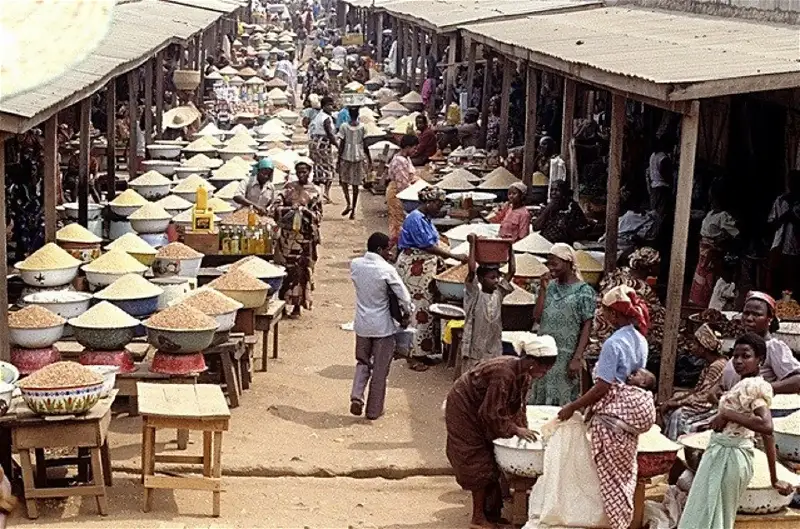

Confirming this trend, dealers in food and beverage products complain of low patronage and consumer apathy.

Expressing her frustrations, a wholesale dealer in different brands of beverages and dairy product (Milk), at Balogun Market, Trade Fair, Lagos, Mrs. Chinenye Orizu, CEO, Chy Ventures, said that the constant increase in the prices of the products her company deals on by the manufacturers has led to significant drop in the level of patronage and switch by consumers to unbranded alternatives where necessary.

She said that, most times, customers make quick adjustments and reduce the quantity of the products they had planned to buy, while in some instances, they either buy the most essential or shelve the transaction all together.

She said: “Out of 10 customers that come to our shop to buy something, only three that you tell the price will just buy without pricing. Two will walk away, while the rest, who, probably, are retail customers, will first lament the price increment and then try to price down the commodity before finally making an adjustment on what to buy.

“If retail customers, for instance, come and you tell them the price, say, N16,500 for a carton of their preferred product. Assuming they had already budgeted N15,000 going by the last market price, they have to withdraw. If they planned to buy 10 cartons, they will quickly bring it down to eight or seven cartons so that the money they have will cover the things they budgeted for.

“For the end users, who, for instance, planned to buy a carton of detergent, dishwashing soap, beverages and any other food item, what they typically do is to remove something like detergent and dishwashing soap and take the edibles because the money the budgeted may no longer cover the items in their list.

“From our end as wholesalers that buy directly from the companies, we now ration the money we have to be able to buy little of different products from different brands and stock in order to satisfy the customers’ demand.”

Speaking in the same vein, another dealer, Mr. Innocent Nwokorie, CEO, Godswill Restoration Global Venture, who deals on products of brands like Honeywell, Dangote Sugar Refinery, Flour Mills of Nigeria Plc and Golden Penny, said that sales have dropped so much that, most times, he hardly record any sales some days.

“The constant changes in price is too bad now that the capital we were using before has been badly eroded. It is affecting us everyday. For our customers, when we tell them the price of the products they demanded for, sometimes, they will leave without buying what they came for because of the high cost. Sometimes, we just sit here and sleep,” he lamented.

Companies’ record of unsold goods

As a result of the rising trend of low demand from consumers, manufacturers of food and beverages experienced huge increases in the stockpile of finished goods which prompted a 20 per cent reduction in production.

Reflecting the fall in production, a report by the Central Bank of Nigeria (CBN), shows that capacity utilisation of food and beverage manufacturers fell to 49 percent in the half year to June 2023 (H1’23) from 61 percent in the corresponding period in 2022, indicating a 20 percentage point decline.

Furthermore, Financial Vanguard’s analysis showed that heavy weights like Dangote Sugar Refinery Plc, BUA Foods Plc and Okomu Oil Palm Plc recorded the highest stockpile of unsold goods during the nine month period.

Dangote Sugar Refinery took the most hit as its stockpile of unsold goods rose by 287.05 percent to N23.61 billion from N6.1 billion in 9M’22.

This was followed by Okomu Oil Palm Plc with 156.9 percent increase to N3.52 billion from N1.37 billion in the corresponding period of 2022.

For BUA Foods Plc, the total value of its unsold goods rose to N7.65 billion in 9M’23 from N3.56 billion in 9M’22, indicating a 114.9 percent increase, while Cadbury Nigeria Plc recorded 66 percent increase in its stock of unsold goods to N3.66 billion from N2.2 billion in 2022.

MAN blames inflation, Naira redesign, others

Meanwhile, the Manufacturers Association of Nigeria (MAN) in its First Half 2023 Economic Review attributed the troubling development to the weakened purchasing power of the consumers, brought about by diminishing real household income resulting from the ongoing escalation of inflationary pressures.

According to the Director General, MAN, Segun Ajayi-Kadir, the situation is compounded by the scarcity of naira in the first quarter of the year and the aftermath of the subsidy removal and currency weakness.

Consumers reviewing their priorities – Muda Yusuf

Muda Yusuf, Director General, Center for the Promotion of Public Enterprise (CCPE), who also blamed the mounting inventory of unsold goods on the naira redesign policy and fuel subsidy removal among others, said that consumers are now reviewing their priorities in terms of spending and are concentrating only on essentials.

He said there’s the need to bring down the exchange rate and energy cost in order to effect a reduction in companies’ cost of production.

He said: “If you look at the past nine months or past six months of the year as the case may be, the manufacturing sector, the Fast Moving Consumer Goods (FMCGs) included, experienced a lot of headwinds.

“First, you remember the crisis of election, which had a very negative impact on investors confidence, and the disruptions that the Naira redesign policy caused, particularly for the FMCGs because their operations are driven largely by cash.

“That Naira redesign was a major disruption to the entire distribution chain, especially at the retail end. That was a very big issue.

“Typically, elections normally come with a lot of slowdown in economic activities; demand normally drops; economic activities drop because of uncertainty and all the confidence issues that come with elections. Shortly after the election, we had a new regime and the pronouncement of fuel subsidy removal. The impact of the fuel subsidy removal on production and distribution cost, but more importantly, its impact on disposable income was huge.

“Because the FMCGs are mass consumer products, what has happened to the consumers’ disposable income as a result of the fuel subsidy removal has typically taken a hit on the companies because the consumers are reviewing their priorities in terms of spending and they are concentrating more on very essential things.

“Apart from those that deal in foods, the demand for others like bottling companies and beverages firms have dropped because their costs have gone up because of the energy price and the exchange rate issue.

“So, the energy cost and the exchange rate challenges have driven up their cost of production, and have led to an increase in prices of their products. So, because consumers can no longer afford their products, that must have been responsible for the high inventory that we have seen.”

Continuing, he said: “There is the need to fix the macro-economic environment and drive down the exchange rate issue because the inflationary impact of it is very high. If we are also able to bring down the energy cost, hopefully, you will see a reduction in their cost.

“Again, if we are able to see refining of domestic petroleum products, that will also bring down the energy cost. At the micro level, the companies also need to review their business model and strategy and see how they can adjust to the current realities of the market.”

Source: Vanguard

Kamagra 100mg: Kamagra 100mg price – buy kamagra online usa